Instead, COGS is reported on the income statement and directly affects the inventory figures which are shown on the balance sheet. The balance sheet reflects the ending inventory, which is directly influenced by the COGS calculation. In other words, divide the total cost of goods purchased in a year by the total number of items purchased in the same year. If you’re a manufacturer, you need to have an understanding of your cost of goods sold, and how to calculate it, in order to determine if your business is profitable.

Calculating COGS using a Perpetual Inventory System

Though not all firms can showcase such a deduction on their income statement. Businesses that offer certain services, like accounting, real estate, legal, or consulting services, instead of goods to their customers cannot showcase COGS on their income statement. This ratio also helps the investors in deciding the company stocks in which they must invest for a profitable portfolio.

Accounting Methods and COGS

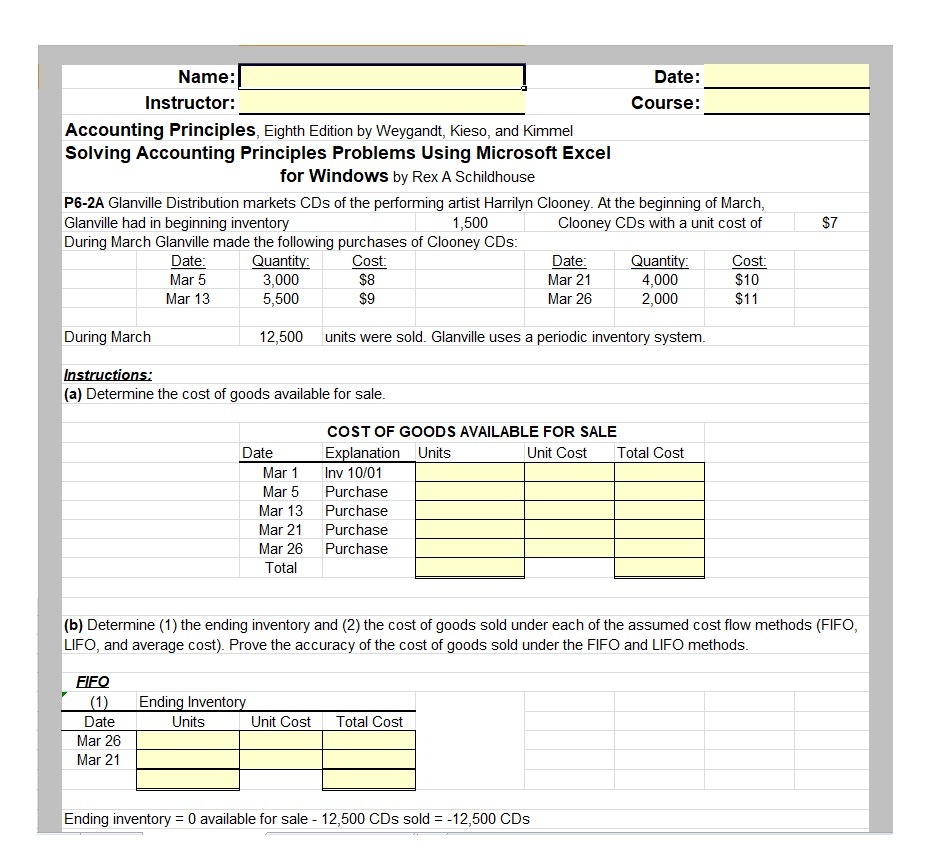

These include specific identification, first in first out (FIFO), and weighted average cost methods. Calculating and tracking COGS throughout the year can help you determine your net income, expenses, and inventory. And when tax season rolls around, having accurate records of COGS can help you and your accountant file your taxes properly.

Would you prefer to work with a financial professional remotely or in-person?

To find the COGS, a company must find the value of its inventory at the beginning of the year, which is the value of inventory at the end of the previous year. The cost of goods made or bought adjusts according to changes in inventory. For example, if 500 units are made or bought, but inventory rises by 50 units, then the cost of 450 units is the COGS. If inventory decreases by 50 units, the cost of 550 units is the COGS. At the beginning of the year, the beginning inventory is the value of inventory, which is the end of the previous year. Cost of goods is the cost of any items bought or made over the course of the year.

- In other words, divide the total cost of goods purchased in a year by the total number of items purchased in the same year.

- While this may entail a higher initial investment, it can pay off in the long run by reducing your overall costs.

- While these costs are incurred to generate revenue, they are indirect costs that don’t involve the product itself.

- The calculation of COGS is the same for all these businesses, even if the method for determining cost (FIFO, LIFO, or average costing method) is different.

You can then deduct other expenses from gross profits to determine your company’s net income. Cost of goods sold (COGS) is calculated by adding up the various direct costs required to generate a company’s revenues. Importantly, COGS is based only on the costs that are directly utilized in producing that revenue, such as the company’s inventory or labor costs that can be attributed to specific sales.

Optimize Inventory Management

Let’s say the same jeweller makes 10 gold rings in a month and estimates the cost of goods sold using LIFO. The cost at the beginning of production was $100, but inflation caused the price to increase over the next month. Using LIFO, the jeweller would list COGS as $150, regardless of the price at the beginning of production.

Very briefly, there are four main valuation methods for inventory and cost of goods sold. They may also include fixed costs, such as factory overhead, storage costs, and depending on the relevant accounting policies, sometimes depreciation expense. COGS are the direct costs tied to the production of goods, which are almost always variable in nature.

If a company orders more raw materials from suppliers, it can likely negotiate better pricing, which reduces the cost of raw materials per unit produced (and COGS). For instance, the “Cost of Direct Labor” is recognized as COGS for service-oriented industries where the production of the company’s goods sold is directly related to labor. Gross margin is the percentage of revenue that exceeds a company’s Costs of Goods Sold, calculated using the formula below.

In addition, users could initially assess how well the company manages its procurement function in terms of economy, efficiency, and production process effectiveness. This is not fair if the product or raw material price significantly fluctuates. This type of method is also not allowed phoenix accounting corporation based on the current accounting standard (IFRS). Generally speaking, inventories valuation methods include LIFO, FIFO, and Weight Average Cost and Inventories. Now, to illustrate the formula above we will provide an example of how to calculate the cost of goods sold below.